|

In its latest outsource report, the research and

advisory firm Gartner Inc. cites cost reduction as

the number one reason organizations choose to

outsource.3 Findings of a study by EquaTerra, a BPO

expert sourcing advisory firm, echoed that

conclusion when 56% of its pharmaceutical

respondents listed cost reduction as outsourcing’s

primary benefit. Coming in second (at 44%) was

improving stakeholder ROI by dedicating and

redirecting focus to more strategic activities.4 The

increased number of outsourced service providers

available to the life science C-suite is a testament

to the success of the model in achieving the

aforementioned goals. However, negotiating the

minefield of outsourcing providers and offerings -

and selecting the ones that will work best with an

organization - can be a daunting task. Manufacturers

considering outsource opportunities will gain a

competitive edge by thoroughly evaluating business,

financial and partnership considerations when

contemplating what and whether to outsource.

Section One - Business Considerations

Determining What to Outsource

In the

next five years, outsourcing in the pharmaceutical

segment will increase as companies are required to

focus on efficiency improvements to compete in

today's market. Companies are expected to take a

much more critical view of nearly all internal

operations – including those they have traditionally

managed and viewed as core to the organization.

Certain financial services, contract management and

order-to-cash processing are now all easily

outsourced as well. Customer Service and Medical

Affairs may also be effectively managed outside

company walls, depending upon the product line being

considered. It wasn't very long ago that commonly

outsourced activities, such as manufacturing,

clinical trial management and warehousing and

distribution, were considered core to the

organization and therefore remained "in-house.”

Using

core competency as the sole outsourcing “filter” has

proven to be a somewhat flawed model in recent years

as functions typically understood as “essential”

have been successfully outsourced with great

success. While core vs. non-core may in some cases

continue to serve as an appropriate filter when

determining what to outsource, it is just one of

many points of consideration life science

manufacturers may use to evaluate potential

outsourcing opportunities.

Consider the Following Potential Outsource

Evaluation Filters:

|

Non-Core: |

All non-core competency

functions /sub-functions should be evaluated

as outsource opportunities. |

|

Problem Areas: |

A function/sub-function

currently causing issues or problems for the

organization should be considered.

(Outsourcers may serve as effective change

agents) |

|

Subject Matter Experts: |

Rather than hiring highly

paid, underutilized experts, who are

difficult to find and easy to lose, consider

outsourcing to a team of experts, and pay

only for required services. |

|

Subsidiaries Considered for

Divestiture: |

To prepare in advance for the

sale of a business unit, outsource services

that are currently shared with or provided

by corporate. |

|

Expansions: |

Functional areas currently in

growth mode are advantaged by the immediate

scalability outsourcing affords. |

|

New Business Lines: |

Mitigate risk by contracting

out support services for new business lines

rather than burdening a new venture with

significant upfront capital investment and

heavy fixed cost. |

|

Market Uncertainty: |

Protect against the risk of

significant over or under investment caused

by rapid market changes, both favorable and

unfavorable. |

|

Industry Trends: |

Consider outsourcing

functional areas typically outsourced in the

industry – those your competitors have

chosen to outsource. |

|

Political Hotbeds: |

Outsource functions that have

or will draw negative attention to the

company (union issues etc…)

|

|

Complex Business Functions:

(Pain Points) |

Consider outsourcing

functional areas that require significant

staff, time and specialized computer systems

to administer. |

Scalability

Outsourcing allows manufacturers to scale up without

investing the time and money required to hire, train

and maintain staff and allows for immediate

reduction of services without requiring staff

elimination or maintaining excess physical assets

When considering a true outsource/in-house

scalability a comparison of direct and indirect

costs must be taken into consideration. For example,

call centers not only require labor and supervision,

but also occupancy, utilities, phone costs,

technology, training, etc. Fully utilizing an

in-house call center staff is difficult for any

company. By outsourcing a call center, a company

pays only for the time the service provider spends

making or taking the calls. Such end-to-end project

outsourcing provides ultimate scalability by

converting a fixed cost to a variable cost.

Expertise

When

considering outsourcing of a functional area

evaluate your current in-house staff by asking the

following questions:

-

Do

the internal personnel currently managing this

function require high salaries and benefits?

-

Do

they have specific expertise making them

difficult and expensive to train or replace?

-

Is

there adequate bench strength internally – a

backup for every position?

-

Is

the depth of management sufficient to manage the

functional area consistently and successfully?

-

Are

internal resources providing adequate service

levels?

-

Does this department have a track record of

continuous improvement?

-

Does the department have the resources to apply

best practice within this functional area?

-

Is

this department using the latest technological

advances?

-

Is

this department excelling in service

efficiencies that enhance customer

relationships?

As the

last of the baby boomers retire over the next 5 – 10

years, companies will lose a high percentage of

employees that hold the greatest depth of knowledge

and expertise. The resulting decreasing labor pool

will present a challenge for companies. Outsource

providers are staffed with highly specialized

personnel - providing access to a larger talent pool

and a sustainable source of skills. In addition,

outsourced services are provided under a legally

binding contract providing a clear accountability

advantage over internal services.

Section Two – Financial Considerations

Outsourcing - An Economic Value (EV) Boost

In the field of corporate finance, economic value (EV)

is a way to measure management’s ability to create

value for stakeholders. Economic value is defined as

company’s net operating profit after taxes minus a

capital charge for the investment on capital

employed in the business.

Economic value is positively impacted by

outsourcing’s method of cost reduction. By

outsourcing, EV is boosted by taking capital assets

off the books. According to Karl Pichler, an

associate at Stern Stewart -- the company that

conceptualized and trademarked the term economic

value added (EVA ) -- looking at outsourcing simply

as a technique to reduce capital costs is too narrow

a view, “Outsourcing is a key strategic component in

capital management," said Pichler. "Not so much to

avoid the capital charge, but more to make capital

variable and to reduce overall operating costs and

capital costs.”

Whether your financial metric is EV, return on

investment (ROI) or internal rate of return (IRR),

the strategic use of outsource partners can improve

the financial health of your company.

Cost Reduction Achieved through Shared Services

As life

science executives contemplate outsourcing options,

strong consideration should be given to the savings

achieved through shared services. In the shared

services outsource model, multiple companies within

the same industry are able to further increase

efficiencies and reduce costs by using third-party

providers, also referred to as shared-use

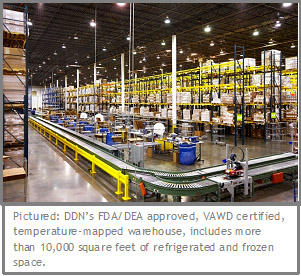

distribution providers. To achieve optimum benefit from 3PL shared services,

it is important to utilize an industry specific

provider. The warehousing, tracking and distribution

of drugs, biotechnology products, and hazardous

materials requires Food and Drug Administration

(FDA) and Drug Enforcement Administration (DEA)

level compliance such as high-level security and the

use of pharmaceutical grade warehouses.

To achieve optimum benefit from 3PL shared services,

it is important to utilize an industry specific

provider. The warehousing, tracking and distribution

of drugs, biotechnology products, and hazardous

materials requires Food and Drug Administration

(FDA) and Drug Enforcement Administration (DEA)

level compliance such as high-level security and the

use of pharmaceutical grade warehouses.

Perhaps

the most regulated of all industries, the life

science industry presents one of the most demanding

distribution and supply chain management challenges.

Regulatory requirements, the need for lot control

and quality assurance require 3PLs servicing the

life science market to create and maintain best

practice levels of accuracy, productivity and

efficiency. By sharing space in an FDA/DEA compliant

3PL facility and by outsourcing related I.T.

services and systems -- such as warehouse management

systems, contract management, order to cash and

accounts receivable -- 3PLs are able to spread costs

across multiple client manufacturers. As a result,

the overhead required for each client is lower and

start-up risks for new products are minimized.

Capital Outlay

Internal business units fight a continuous battle

for the resources necessary to keep pace with

changing technology and business standards set by

customers and regulatory agencies. Often, internal

groups don’t receive authorization for needed

capital investments until after a regulatory

observation has been made or a customer complaint

received.

Outsource companies are required to look at the

changing healthcare landscape and invest proactively

in best practice as a means of remaining

competitive. They are quick to adapt to changing

market demands and regulation and are able to spread

required investments across multiple client

companies. This aggregation eliminates the

redundancy and expense of each company building a

unique solution and ultimately removes cost for the

entire channel; companies may look to outsourcers as

a way to maintain a competitive base without

maintaining expensive infrastructure.

Carole Pfeil is the vice president of Corporate Communications, Dohmen Company. As the VP of Corporate Communications Carole works to positively position Dohmen, DDN and RESTAT in the eyes of key audiences — employees, clients/prospects, shareholders and local communities --through proactive public relations and publicity efforts. She has worked in communications capacities specifically in the Pharmacy and PBM spaces for more than 15 years. Prior to Avicom she was the Director of Business Development and Marketing for IHS, a unit of IMS Health, whose 8000-employee workforce supplies consulting, PBM auditing and business process outsourced services to the life science industry. Earlier experience includes rising from Technical Writer to Communications Specialist and then Manager of Communications and Public Affairs for Honeywell-Bull (Bull-HN) a French-owned company with a worldwide presence in more than 100 countries, particularly active in the health care and telecommunications sectors. She also works with DDN and RESTAT’s leadership and marketing teams to ensure branding consistency while creating dynamic internal and external communications tools to help inspire our workforce and reach our client and prospect audiences with compelling messages that extend our corporate vision. Recently she has completed a high level white paper on Outsourcing in the Life Science Industry. For article feedback you can contact the author at

Cpfeil@dohmen.com

|

|

|

|

|